$10-20M Vehicles vs. Trillion Dollar Capital Gap

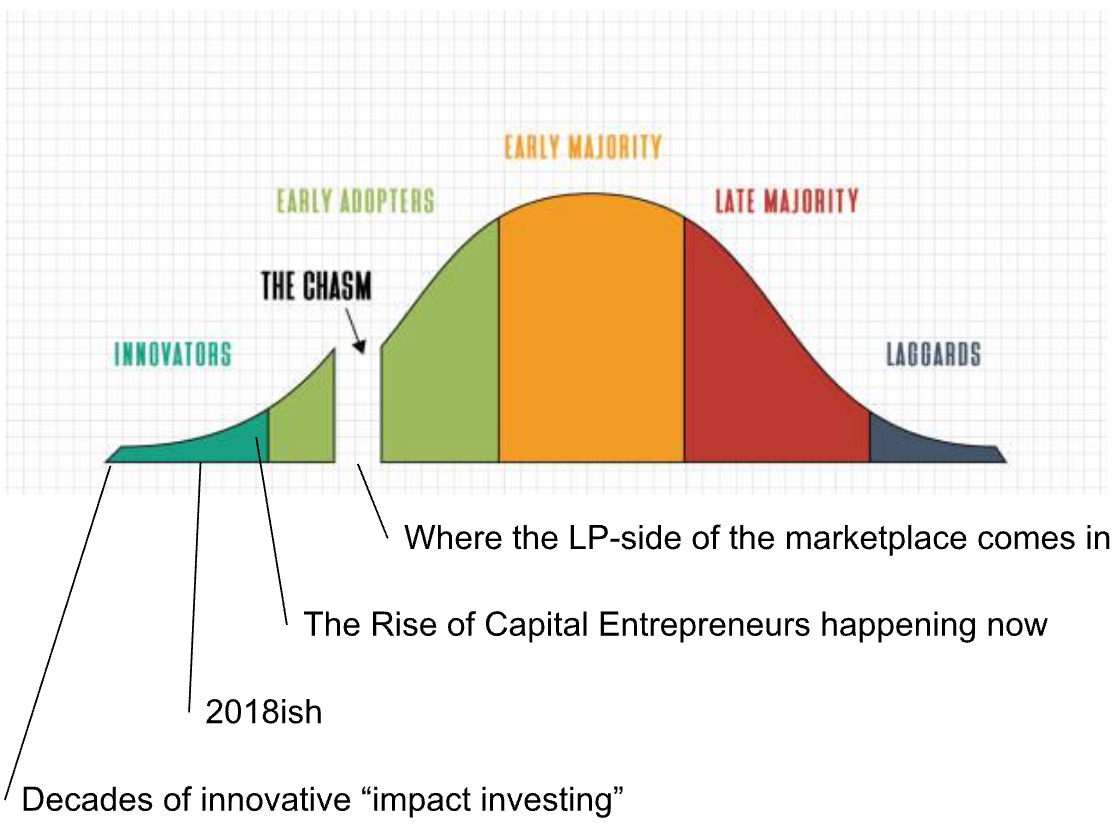

"Rise of the Capital Entrepreneur" <> meet LP ecosystem. Or fall into the chasm.

On a recent call, Dr. Astrid Scholz from Zebras Unite made a savvy, brutal observation (and very on-brand) observation:

The change we need is going to take more than a few ten and twenty-million-dollar vehicles.

I agree and thought its merit was worth unpacking.

First off, the founder capital gap is in the hundreds of billions, if not trillions, of dollars. No wonder the 2023 Kauffman Foundation report, Access to Capital for Entrepreneurs titled the first section quite plainly:

Entrepreneurs Still Face a Considerable Capital Gap

More specifically:

In the 2019 report, we found that 90% to 95% of employees will need some capital to start their business and that 83% of those businesses do not access capital from external private institutions. These numbers have not changed since 2019.

The math is pretty simple. It takes a metric shit ton of ten and twenty million dollar funds to close that gap.

However, the size of the funds is not the problem.

Practically speaking, funds often in this realm, especially innovative ones. Indie VC started as an $800k experiment in 2015 and is now seeking to surpass the nine-figure mark eight years later. We need these nine and maybe even ten-figure funds to deploy thematically at scale, but they all have to start somewhere closer to zero. It takes time.

For many funds, often with local or niche strategies, maximizing AUM isn’t compatible with success. They succeed by staying small. Traditional venture capital has proved this phenomenon.

Instead, we need more ten and twenty million dollar funds. I’ll go even further, we need more one to ten million dollar funds so we can fit a focused vehicle into every back alley and far-off corner of the economy (the interesting places where Zebra companies often hang out). Community-based capital needs to be bespoke to the community, like this theoretical $4.2M fund for a city of just of 100k people. The capital gap could not be more heterogeneous, making ample room for pointed, niche capital vehicles.

Just like we need companies of all shapes and sizes, we need funds of all shapes and sizes.

Now, let’s recap the state of innovative GPs:

The change we need…

(potentially trillions of dollars in new funding pathways)

Is going to require countless $100M+ capital vehicles…

(if not some $1B+ ones)

AND thousands of micro-funds.

(erring towards <$20M)

It may sound impossible, but I actually think the GP ecosystem is already on the right trajectory.

Just five years and a lifetime ago, I was chatting with Jonathan (coauthor of this blog and GP @ Capacity) and Kieth (Novel Capital) constantly. We were pre-first close and laboriously comparing and contrasting our ideas for funding entrepreneurship. My fund ultimately incorporated a redeemable equity structure with a fund strategy that keeps our AUM scaled to our niche market ($27M for rural Colorado only). Jonathan proved a nimble redeemable equity fund model, starting in his Southeast region (but not stopping there…). Meanwhile, Novel has crossed the nine-figure mark thanks to a $100M line of credit from Community Investment Management (Founder’s First has one of these too!). We’ve even had one of our rural Colorado companies delay their Series A and opt for Novel’s revenue-based debt instead. We’ve come a long way.

We’re far from alone too. In 2018, it was difficult to find enough practitioners to fill a room. I can now vouch, that is no longer true. Anecdotally, I’m discovering a new innovative financier every week instead of what used to be every other month. We all started as “wheel-spinners” and now we’re becoming GPs with AUM writing real checks.

This is undoubtedly thanks to deliberate ecosystem building and tooling to support up-and-coming GPs with innovative models. The Innovative Finance Playbook is chock-full of case studies, financial models, and term sheets waiting to be employed. Tools like LoanWell and Ned even provide the backend software to get the money out the door and back soundly. Catalyze has programming to support the next generation of investors and lenders thinking differently. We would have died for these resources five years ago.

As long as we keep putting in the work, the rise of the capital entrepreneur will continue.

But…

…Will it continue fast enough to provide good news in the next Kauffman report? Fast enough actually dent the founder capital gap in this decade? Will we cross the chasm?

This is where the other side of the marketplace comes in.

We need more LPs to cross the chasm.

And we’re not there yet.

At the risk of sounding like another GP whining about not enough LPs, let me explain why I think the innovative LP market could use some attention.

When Astrid said, “a few ten and twenty million dollar vehicles,” I’ll suggest she was fondly referring to the GPs who have successfully grown to this AUM. Recall, we need this celebrated “few” to become a shit ton, and “ten and twenty” to become one, five, ten, twenty, one hundred, one thousand, etc, etc. And we’re starting from zero.

Thus, her point is: let’s graduate from the minors to the majors.

That will take a vast, diverse LP-base ready to scale innovative finance to the majors – which doesn’t exist yet.

The near-death of Indie VC demonstrated that institutional capital was not ready. In the face of a trillion-dollar opportunity, the most well-known, mature fund with undeniably strong return metrics closed shop. While Indie may be back, the lesson was clear - it will take more than returns and a strong GP/founder brand.

I happen to know a number of innovative funds that also have stellar returns and still have to scrape and claw their way to find the next fund. As any early-stage GP should know, you can’t just “build it and they will come.” The same logic applies when returns are the product.

Lastly, I’ve seen too many GPs get pushed back to traditional debt or venture by their prospective LP base. There aren’t enough resources out there to prevent “innovative” fund models from sounding like “risk and uncertainty.” GPs that do raise are having to contort their message to try to make it sounds as vanilla as possible. We will never know how many millions of dollars and dozens of funds hoped to deploy innovatively, only to be buoyed back to the debt-equity paradigm in order to reach a first close.

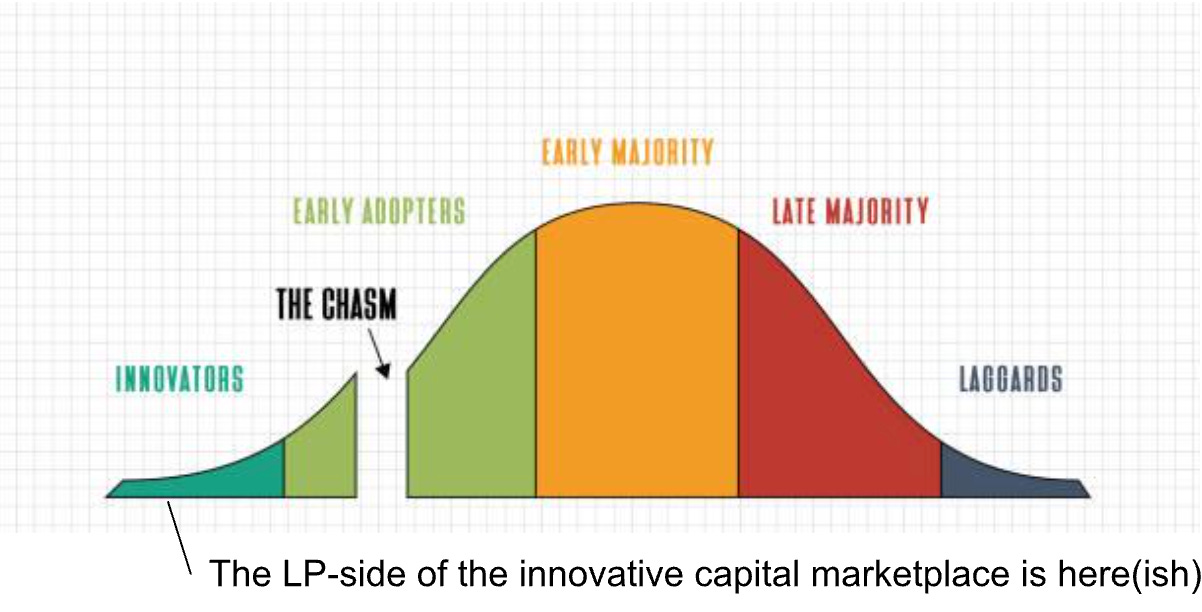

The LP side is not ready to cross the chasm, thus, nor is the GP side.

So what will it take?

Just to say it out loud - yes, GPs - we will still need returns.

Though I’m a GP and relative outsider to LP circles, it feels a lot like the nascent GP community of 2018. We had a few GPs with real-world experience, a lot of interest, and a long road ahead of info-sharing, open-sourcing, and random calling and connecting. Eventually, this becomes a collective community trying. And then real allocations and real checks getting written.

Sure, family offices have special dynamics. Yes, institutional investors have practical constraints and fiduciary duties. At the end of the day, it is all the same friction.

My hypothesis is that we need to borrow from the playbook used to set the rise of GPs on its current trajectory.

To be fair, we’re not starting at zero.

In 2019, the Capital Access Lab, supported by the Kauffman and Rockefeller Foundations, piloted a fund of funds that put $3.4M to work in six different ass-kicking innovative fund managers. The ImPact and Known are making moves. As mentioned, Community Investment Management is supporting innovative debt providers with big numbers, but they can’t be the only one. This is far from an exhaustive list, but the takeaway is simple: the community of LPs is nascent. We need to graduate from pilot projects and name-brand foundations bolstering GP balance sheets to an ecosystem of diverse, innovative LPs.

On the other side of the chasm, the LP landscape looks like family offices, endowments, and pensions clamoring for allocations in scaled, thematic capital providers. Family offices and foundations will find diversity in their “alternatives” portfolio through zebras of all colors in communities of all sizes. Local angels and crowdfunds will fluidly support local coops, moonshots, and everything in between.

I’m yet to find a capital allocator who doesn’t want this future, they just don’t yet know how to invest in it.

As a two-sided marketplace, innovative finance needs to build the community scaffolding for the LP ecosystem to scale with the rising GP ecosystem.

Innovative Finance Updates