The Feynman Commission for Capitalism

On fixing systems...what problems are you spotting?

Welcome to the 164 new subscribers to the Innovative Finance Newsletter in the last month.

For the short version of this week’s edition: what problem with our financial landscape are you working to fix, and how? We’d love to know in the comments.

As for the longer-version…

The Feynman Commission on Capitalism

On a cold Florida morning in 1986, six American astronauts and one American schoolteacher boarded the Challenger space shuttle, passed their pre-flight checklist in coordination with their land-tethered teams, and proceeded to launch beyond the stratosphere. 46,000 feet over the Atlantic Ocean, the shuttle exploded and all seven lost their lives.

Famed former U.S. Secretary of State and Attorney General William Rogers was tapped by Ronald Reagan to lead the 12-person investigation into the tragedy, now known as the Rogers Commission. Reagan wanted answers, but sensitive to NASA’s prestige, also gave Rogers a second, subversive directive: “Whatever you do, don’t embarrass NASA.”

Richard Feynman, one of the twelve investigators, provided answers. And embarrassed NASA.

Within the American psyche, the letters N-A-S-A were untouchable. Directly adjacent to them, amidst the hallowed ground of America’s prideful, benevolent ego was, and is, capitalism. They’re pillars of our Western religion.

However, today’s capitalism needs Richard Feynman. In fact, we need a lot of them.

That’s where you come in: The Feynman Commission.

So what is a Feynman Commission?

Unlike a Rogers Commission which shows up after system failure, a Feynman Commission creates a culture of identifying system failures and proactively fixing them.

Before our Commission commences, however, it is critical to understand the Feynman approach. To do so, let’s return to Richard Feynman, the one who was asked to join the prestigious Rogers Commission by William Graham, a former student of his and then Director of NASA. Feynman’s initial response to Graham was, “your ruining my life!”

He eventually accepted the invitation, albeit skeptically.

“Although it looked like we were doing something every day in Washington, we were, in reality, sitting around doing nothing most of the time,” the physicist remarked a few days into the Commission. Nonetheless, Feynman continued to poke and prod, earning a reputation for showing up where NASA didn’t want him and asking questions NASA didn’t want to answer. In response, Commissioner Rogers barred him from visiting the NASA headquarters, where he would chat with the staff physicists. One afternoon, Rogers even interrupted Feynman, midstream questioning a witness, to close the day’s session. Feynman’s skepticism was confirmed.

On the other hand, Rogers correctly suspected an inevitability. Feynman was going to embarrass NASA.

But not until he converted into a card-carrying member of the NASA fan club.

By February 9th, 1986, a New York Times article suggested the prime suspect for the Challenger tragedy - faulty O-rings between the solid rocket booster (SRB) and the fuel tank. The article beat the Rogers Commission to the punchline. NASA was starting to blush.

That evening, William Graham extended a peculiar invitation to Richard Feynman - a VIP showing of The Dream Is Alive, an IMAX documentary featuring the NASA shuttle program.

Feynman’s admitted “semi-anti-NASA” attitude transformed. “I could see that the accident was a terrible blow. To think that so many people were working so hard to make it go—and then it busts—made me even more determined to help straighten out the problems of the shuttle as quickly as possible, to get all those people back on track,” he wrote.

Finding the fault (which he did in collaboration with other members of the Commission), was the first step in getting NASA back on track.

But calling out NASA’s culture of intellectual dishonesty was the critical step.

During a live televised Rogers Commission hearing, Feynman placed a small, rubber O-ring with a C-clamp clasped around it from a glass of ice water.

The O-ring was a scale model of the same one connecting the Challenger’s external fuel tank to its solid rocket booster, the same one featured in the New York Times article. The C-clamp, which Feynman bought that morning at a local hardware store, represented the pressure the O-ring was under as the thruster powered up at the launchpad. The ice water was nearing 32 degrees Fahrenheit, the air temperature of Cape Canaveral on launch day.

When the Commission’s attention turned to Feynman, he removed the O-ring from water and removed the clamp. It did not expand like the dynamic seal it was supposed to be. It remained stiff and impliable. This phenomenon allowed hot, pressurized gas to leak out of the solid rocket booster and subsequently ignite. It was an unforgettable display for the whole nation to see.

The Commission of 12 experts, stacked with NASA elite like Neil Armstrong, was not supposed to discover such a simple, damning fault. Even worse, the issue had been identified and voiced before the launch. This fatal technical failure was avoidable, so long as it had a healthy system to catch it. It did not.

The newly pro-NASA Richard Feynman deeply embarrassed NASA and American ingenuity at large. He chose to inflict a temporary wound–out of curiosity and empathy. Open mind. Open heart.

With this approach, we, the Commission, may return to capitalism, our collective NASA for exploring and expanding human vitality. Instead of physics, it relies on economics. With each birth, barn-raising, demo day, and incorporation, it conducts another launch.

Unfortunately, there are faulty O-rings and signs of systematic failure aplenty.

All systems have failures. Good systems identify and correct them. Bad systems not only fail to identify failures but tolerate them until system failure.

Feynman found NASA to be a bad system worth fixing.

As for capitalism?

To start, this Commission member finds capitalism is not worth dismantling.

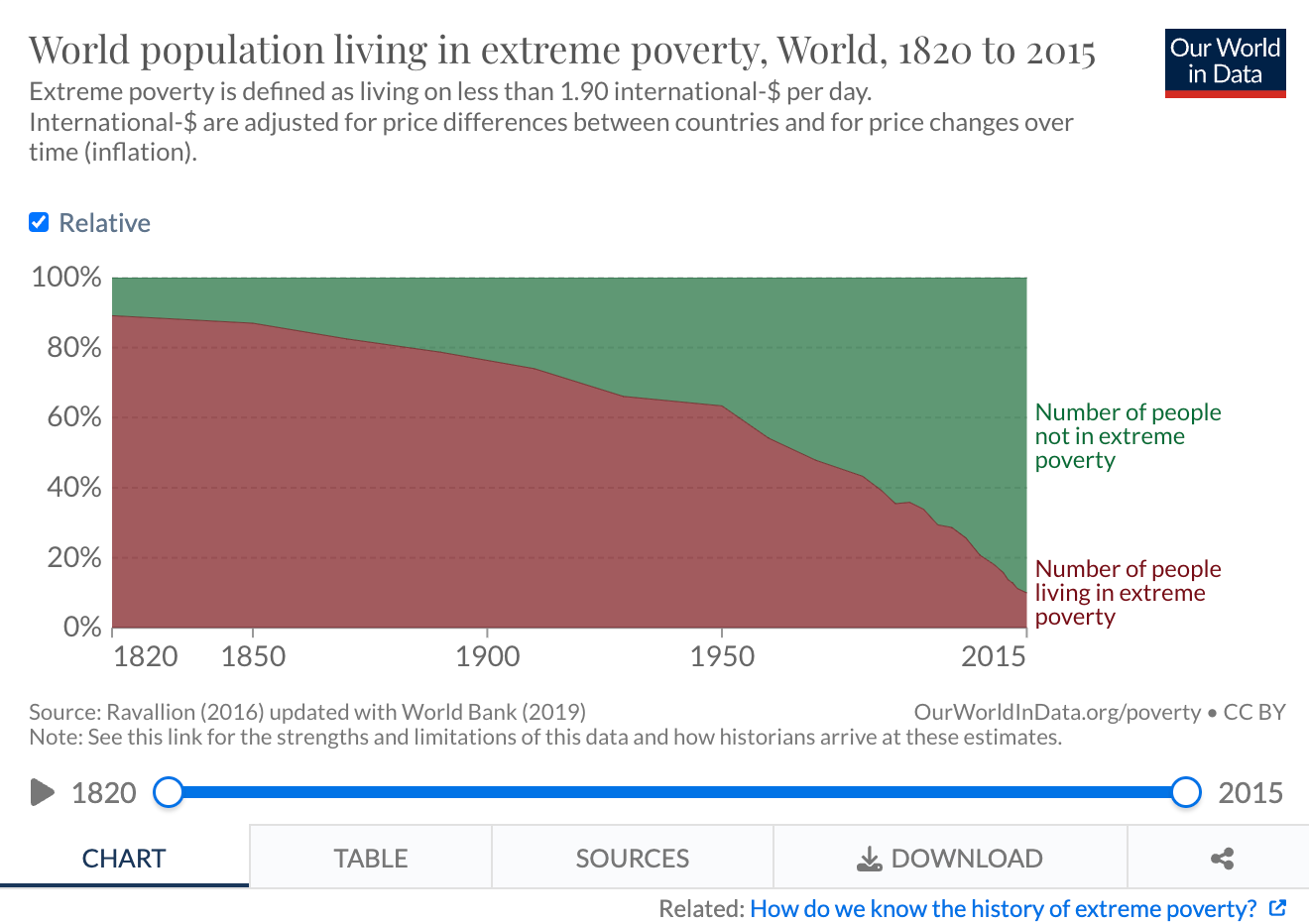

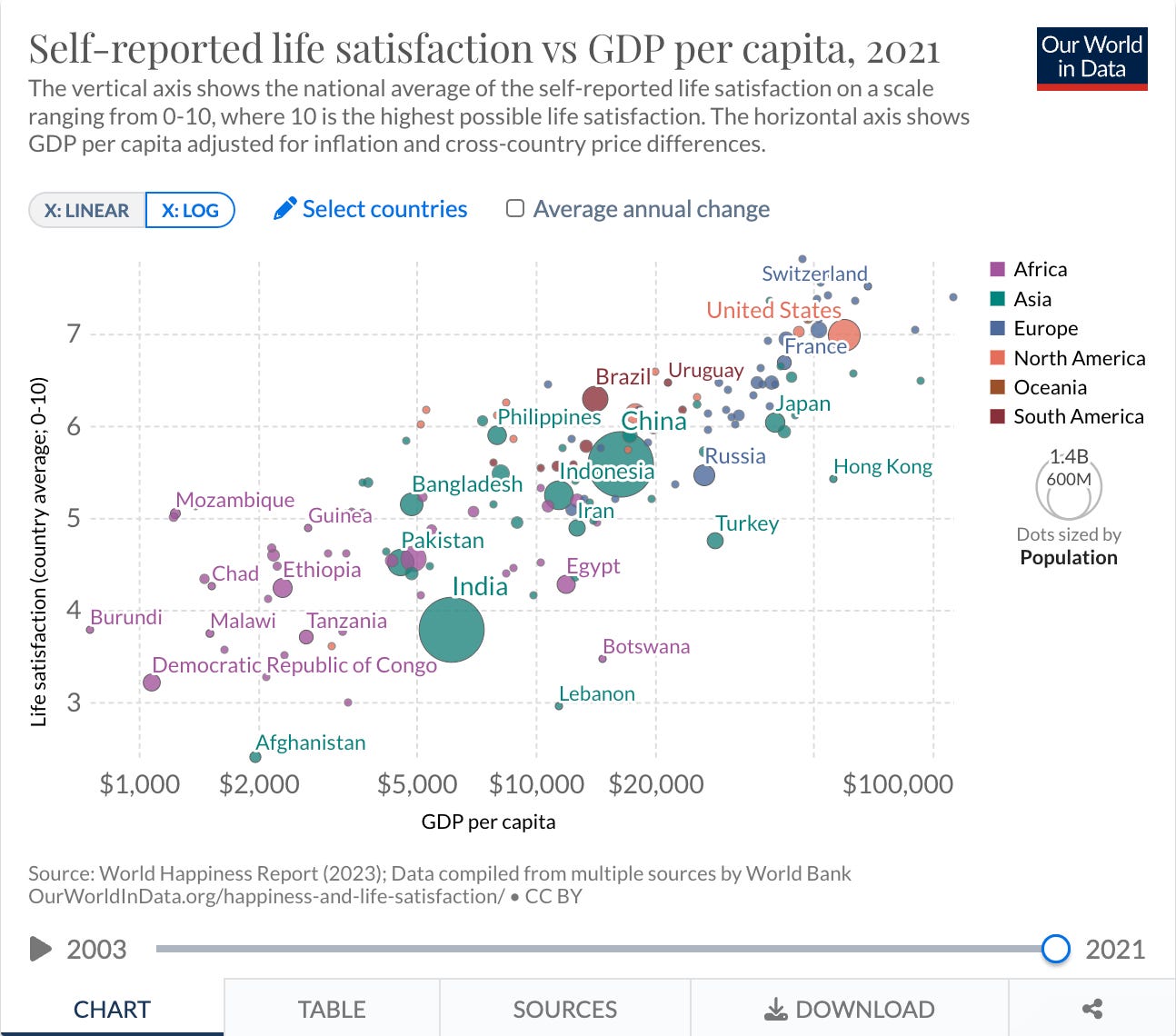

Capitalism is an effective engine for reducing poverty, particularly when combined with effective government, and focused on the production and distribution of key goods and resources. Economic growth is correlated with a more equal distribution of happiness, and income is correlated with life satisfaction.

According to this data (and please do share counter data!), it is a system worth keeping. It suits our hedonistic wiring. It is the best system we have (so far).

Following the disaster, a review of the Challenger’s launch showed a dark plume of smoke coming from between the SRB and the fuel tank - the leak from the faulty O-ring. It was happening, heartbreakingly, in plain sight.

In a perfect system, in a perfect world, there would have been a Feynman Commission monitoring this plume. They would have called off the launch, fixed the O-ring, and then relaunched.

In our imperfect world, and imperfect capitalist system, there are dark plumes of smoke aplenty. Our launch protocols are fraught with faults.

As members of the Feynman Commission, it is our job to spot them, voice them, and fix them. Launches will continue. It is our job to ensure they are successful.

What are the dark plumes of smoke you’re spotting?

And how should they be fixed?

>> You can answer this in the comments (I’ll even go first).

The Catalyze team has submitted three session ideas for SOCAP Global. If any of these look interesting to you, please give them a vote!

A New Fund Model for the 99%: Innovative Capital Products for Entrepreneurs

From Asset Allocator to Entrepreneur: A Dive into the Innovative Capital Supply Chain

Shaking the Status Quo: The Unique Competitive Advantage of Emerging and Underrepresented Fund Managers

Overcoming the Structural Hurdles of First-Time Fund Manager Success

Neighborhood Economics is coming to Jackson, Mississippi April 24-26 (and large institutional funders will be there).

Jeffrey Ashe is sharing a model for savings circles and remittances in Lynn, MA.

WEPOWER is hiring for numerous amazing roles to advance its mission of building community wealth and power, centering Black and Latinx communities.

Empowering First-Time Fund Managers with Maegan Moore (yes, again from Catalyze!) on the More Than Profit podcast.

Plume: capital providers not ensuring the capital they provide is accretive, not starting with that as a key starting point.

Suggestion: dare I say...better, more intelligent regulation?

Plume: Limited pathways for companies requiring risk capital

My suggested fix: Broader spectrum of risk capital products, partners, and narratives