Low-hanging Fruit: Maximize then Pick.

Navigating Returns and Impact Pt. II

I’ve been searching for an intellectually honest framework for the role of capital in generating returns and impact.

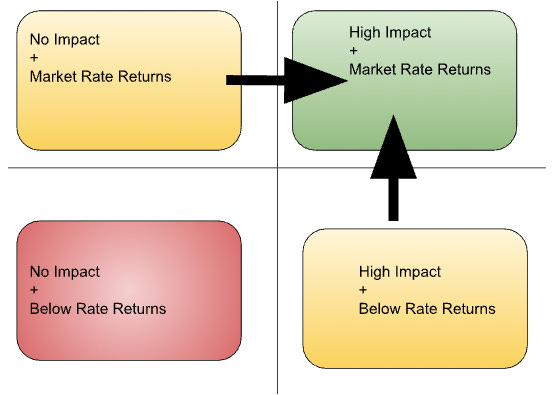

Last week, I started at the individual investment level, aiming to find a third path between the for-profit and anti-profit maximalists. This was my takeaway:

Recapping the Tribal Thinking Trap

This allows investors to avoid fallacies of tribal thinking and consider the potential of both profit and impact as non-causal, independent outcomes. Maybe, a devout capitalist (The Friedmans) will hear out that next pitch for a high-impact company, opening to the possibility that its return potential lies in its impact potential. Maybe, a foundation or impact investor (The Anti-Friedmans) can soften their anti-capitalist sentiment enough to see how market returns can scale their impact. I’ve seen smart investors fall into both traps. Hopefully, this is an intellectually honest common ground that unclogs latent impact and returns.

From here, it would be tempting to prescribe that we maximize companies in the top-right quadrant. Impact gets maximized; everyone gets rich; no one has to compromise.

Of course, that is egregiously simplistic.

The real-world implication is that we shouldn’t miss these win-wins in the top-right quadrant due to tribal thinking.

Low-hanging Fruit

Where there is low-hanging profit and impact, pick it. Everyone.

But what about ventures that live in nuance?

To start, (and punt on nuance) if it can be a low-hanging fruit, make it low-hanging fruit.

This may seem obvious, but it is well worth stating. If you’re in the yellow quadrant and can make it green do so.

This means adding whatever is missing - profit or impact.

Patagonia started as a for-profit company and then added impact as it minimized its impact and grew its role as a leader in corporate citizenship. Its net contribution to societal well-being, aka impact, grew greatly, moving it from the top left to closer to the top right. I’d argue it even became a better for-profit investment in the process too.

What about the inverse? Where there is high-impact and unclear profit, is there a move to be made?

On a case-by-case basis, maybe, maybe not. Per the notorious Pallotta Teamworks case study, profit is often too good of a motivator to be ignored. Some issues are mischaracterized as unprofitable too. Climate change was long seen as a philanthropic endeavor. Today, $490 billion has been invested in “un**** the planet.” Many opportunities in climate change have been recharacterized from do-gooding to low-hanging fruit.

These examples simply prove that low-hanging fruit is often within reach, even when it isn’t obvious to start. More ventures can exist in the top right quadrant than one may realize.

And after we’ve picked all the low-hanging fruit?

This is all good and dandy, but we still have not addressed any real nuance.

By now, the realists are thinking:

Many opportunities simply do have a tradeoff. A logging company makes money by cutting down the forest. We all benefit from clean air, but good luck charging for it.

And the skeptics can sum up the entirety of this philosophical finance ramble with:

So you just want to see how much we can feed The Capitalist System?

I think these are fair critiques.

Capitalism has limits and pitfalls. An intellectually honest framework to navigate impact and return tradeoffs requires revisiting capitalism.

It is one hell of a machine. I’ll say that much. Stay tuned for Part III…

Innovative Finance Jobs

Common Trust enables lucrative employee ownership transitions for the 3/5 small businesses seeking a sale in the next decade. They are hiring: