Disentangling Capital Structure from Price

The most expensive capital is inappropriate, and not how you think

Let’s try to disentangle capital structure from capital price in three parts. The first two are steps towards understanding how these two get conflated, while the third step is the actual action to take.

Cost of Capital ≠ Structure of Capital

Minimal Portfolio Innovation

Structure then Price

Writing this evolved my own thinking around capital gaps and provided me with clarity around potential solutions. Maybe you will find it helpful too.

Cost of Capital ≠ Structure of Capital

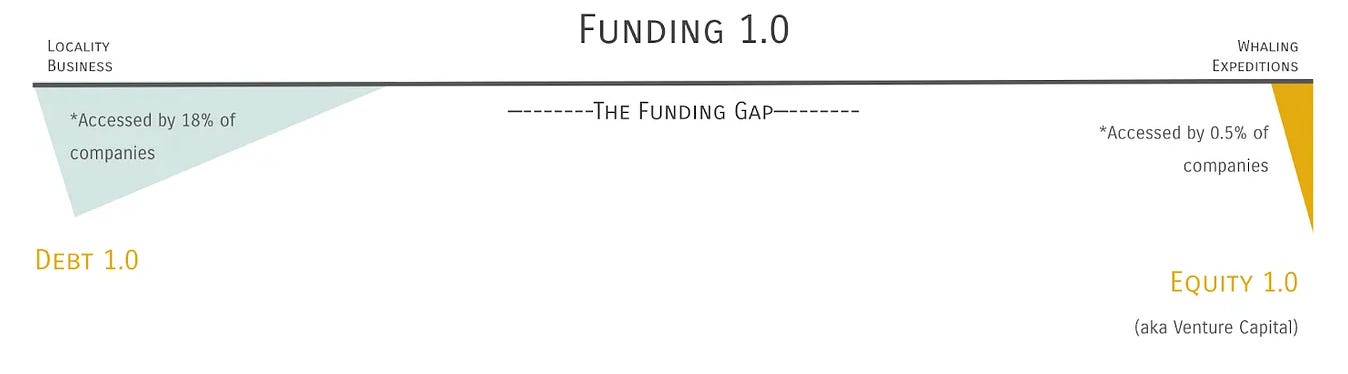

In 2018, a number of us gathered in Denver to discuss what, at the time, we called “alt cap.” We were united by the 81% (now estimated at 83%). That is the percentage of new businesses not served by institutional capital according to Kauffman. Neither bank debt or venture capital’s preferred equity serves this majority of entrepreneurs.

We made a mistake in our takeaway however.

It is true that 83% of new businesses are not served by banks or venture capitalists. And it is true that these institutional investors dwarf all other early-stage capital sources in terms of dollars to deploy.

It is untrue that debt, a bank’s capital product, only lives at the low-risk end of the risk-reward spectrum. Or that equity must always occupy the high-risk, high-reward end of the capital spectrum. That is simply where those tools have become most normalized for eary-stage businesses.

The counter examples are rampant. Pay-day lenders offer high-risk loans and a punishingly high interest rate as their “reward” in return. Hedge funds regularly invest in equity conservatively - minimal tolerance for failure nor expectations of breakout success.

So if debt can be high risk and equity can be low-risk, why do we have a capital gap?

Minimal Portfolio Innovation

In the U.S., a “small business” is defined as any company with less than 500 employees. That is a laughably wide aperture. 499 employees makes for the largest employer in most communities. No wonder every politician touts their small business policies, “the engine of America’s economy,” yet we have floundered to support teams of one to three get off the ground for 40 years straight.

This over-simplistic view of small vs. large is not just a technical definition matter. It is indicative of the simplicity with which investor’s build portfolios.

The open space for portfolio construction is quite literally a) less than 500 employees, and b) not a unicorn or bust business model. There are hundreds of hours of VC’s espousing portfolio construction, yet nearly all of them end up at the same 15-30 company portfolios, largely positioning to get into the same 10 or so companies per year that drive all VC returns. It’s much ado about nothing.

Some innovative VCs are discovering an entire world of early-stage businesses that don’t require maximum risk to produce meaningful returns. Equity investors should step up their risk assessment abilities, building portfolios of companies at all ends of the risk reward spectrum.

Bank lending has shown more adaptability, but still has a long ways to go too. The 16% of businesses served by banks are currently the ones that match traditional lending criteria, such as the five Cs of credit.

Innovation in debt typically unlocks insight around default risk that was unappreciated by other investors. In fact, a feature of debt is decoupling business performance from default risk. This allows these underwriting insights to expand well beyond the borders of a business’s financials. For CDFIs, that may be higher resolution character assessment. For predatory lenders, that may be a piece of collateral they would gladly take upon default. Each of them takes a different look at lending risk, then provides debt at the price they find appropriate. From there, it is a matter of simply executing the corresponding portfolio strategy to generate appropriate returns. The challenge is for banks to update their underwriting criteria or for the ecosystem of lenders innovating around lendability to scale up to bank-size assets under management.

Altogether, debt and equity are capital products, not a commentary on a business’s risk or reward. The “reward” required can be high or low. That is between the investor and investee, and not up to the structure of the investment.

So shouldn’t we be able to close the capital gap with just debt and equity? Who needs “innovative” finance?

Structure then Price

With better risk assessment and more diverse portfolio construction, every business could be suitable for debt or equity from a “cost of capital” perspective. However, many businesses do not fit the actual mechanics of these capital products.

Impact Terms distills into the concept of:

Appropriate Capital - the goal of finding the right capital structure to balance the needs of the investor and entrepreneur.

Early-stage equity is not appropriate capital for businesses which do not intend to exit. Similarly, Impact Terms provides a good debt example - if a company’s cashflows are unpredictable, a debt repayment schedule might be impossible to pay.

Nothing makes capital feel more expensive than a conflict due to structural mismatch. Even more so than the cost of capital itself.

If you planned to pass your business onto your kids, the VC’s call to ask about the exit will not be welcomed. If you have no cash on hand and the bank loan is due, hope they don’t take your car.

This is where “alt cap” actually comes in.

Revenue-based investors have seized the “debt-equity” gap, but this strikes me as a function of product positioning, not cost of capital. Counter-positioning to equity and debt has allowed the revenue based world to resonate with those left out by lenders and equity investors. I’m glad they did, as this is the fastest growing sect of innovative finance by far. That said, there is no reason revenue based finance can’t exist at the highest or lowest ends of risk and reward too.

Thinking about cost-of-capital separate from structure-of-capital opens up an endless world beyond traditional debt and equity. We can mix and match capital structure features to ensure appropriate capital is always achieved.

And then set price.

This order of operations matters:

Appropriate Structure

Then Appropriate Price.

That’s all for now. I’ll aim to send one more innovative finance musing your way before the end of the year.

Next year, I’m hoping to get some cross-posting and collaborations, currently in the works, across the finish line.