Funding 2.0

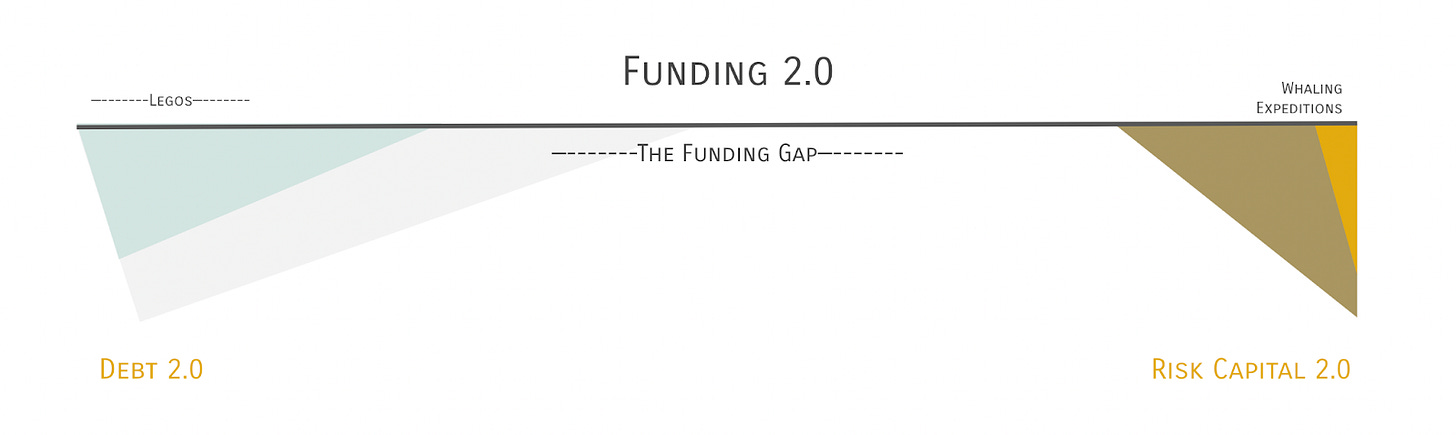

Debt 2.0 + Equity Funding Grows Up to Become Risk Capital

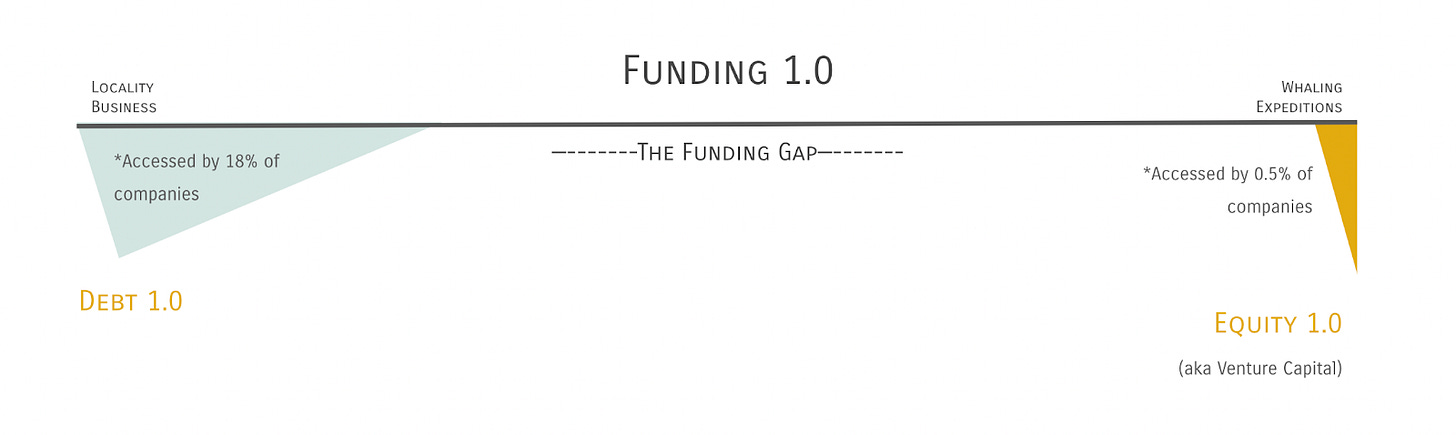

The traditional debt and equity structures of Funding 1.0 are sound options for locality businesses and whaling expeditions. Every day, one of these types of businesses gets started with the help of a traditional debt or equity funder. This will continue. Both debt and equity carry on as integral parts of Funding 2.0.

However, for every business accessing Funding 1.0 - VC or a traditional bank loan - four go unserved.

Bootstrapping is ideal, but often a luxury. Meanwhile, an increasing share of new businesses are incompatible with the debt-equity paradigm. Business models evolve, and so much finance in response.

Funding 2.0 is emerging to close this gap.

On the debt-side, innovation started with what I call Debt 1.5 - more flexible underwriting and lower transaction costs.

First, the concept of a loan got an upgrade. The simple principle and interest rate model gained a ton of financial levers to make debt compatible with more founders. This generally messed with the timing of payments or collateral used to secure a loan, which in turn lowered the effective cost of a loan. The fanciful terms of today’s debt allow lenders to more accurately assess risk, price loans accordingly, and expand their offerings.

Furthermore, technology unlocked more efficient lending. Evaluating a loan is increasingly a task for software. Accessing a loan is as simple as an internet connection. As a result, transaction fees are a race to the bottom.

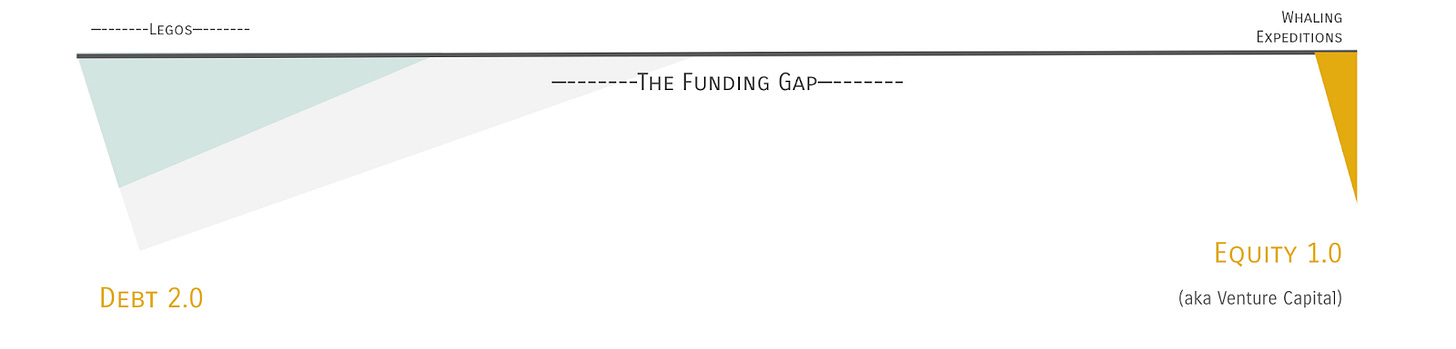

Now comes Debt 2.0 which rewrites the rules of underwriting.

Debt 1.0 and 1.5 use the balance sheet and underwrite against assets. This gives you equipment loans, land purchase financing, factoring for accounts receivable, etc. Should the business’s assets not be suitable to lend against, lenders will even use the personal balance sheet via personal guarantees. Inevitably, an asset will be on a balance sheet somewhere which a lender may claim in the case of default.

Debt 2.0 looks beyond the balance sheet - spotting assets in the making.

The up-and-coming revenue share investors like Lighter Capital, Novel Growth Partners, or Big Foot Capital, expand debt’s reach by looking at the business like a business-builder instead of an accountant. They’ll analyze the overall health of a business and invest in the continued health and growth. In many cases, these firms even approach their portfolio support like VCs - not your typical lender mindset.

Where revenue-share investors will evaluate the company on the whole, some Debt 2.0 lenders have even begun to specialize in the specific legos of a business that they’ll underwrite.

Take Clearco for example. They noticed that the legos of a business were often used to build the same internal machine: performance marketing. When this machine reaches enough scale and predictability, it reliably returns customers. As a result, Clearco (they’re not the only ones by the way) specialized in underwriting the performance marketing machine for businesses to acquire more profitable customers. There is no accounts receivable, just a well-oiled acquisition machine and confidence in the revenue it will produce.

Pipe is another innovative version of Debt 2.0. They started noticing a modern business asset - recurring revenue. Saas businesses proliferated recurring revenue, but countless other business models also use subscription pricing. Whether it is keeping the servers on, or just continuing service, Pipe recognized the financial asset of ARR (ann. recurring revenue) before it hits the balance sheet as cash and funds it in present-day value. As soon as the sales team closes a contract for ARR, investors on the Pipe platform can fund it.

Altogether, these new debt providers expand the “debt” class, helping close the funding gap for founders.

Let’s close this gap yet more, but not with Equity 2.0.

Debt 2.0 is a gamechanger, but it still relies on legos (aka assets) to underwrite against.

What about a company that is just starting? There is no operating history, collateral, or orders to lend against. You don’t yet have the legos for debt.

Early-stage founders need risk capital to build and assemble the legos. They need absolute autonomy over how they spend. Each company has a slightly different order of lego-building which has to be surfaced through a thing called entrepreneurship.

For Risk Capital 2.0, we’ll swap out the lego metaphor for the open sea (no, not that Opensea).

Recall, equity was invented for whaling expeditions, buying them huge runway to remain out at sea until they find whales. Today’s whaling expedition equivalent is a very particular type of startup - one that requires deep VC pockets for deep R+D or blitzscaling.

If a whale is necessary from day one - VC is the correct funding tool. That’s how Elon Musk’s SpaceX and Tesla can run unprofitably for years while becoming multi-billion dollar companies. After years of R+D, they finally turned it into billions of revenue quickly. That’s a whale.

Some expeditions don’t seek whales. In fact, some voyages need not become expeditions at all. Thousands of businesses die each year simply because they were fishing for a whale with a boat, crew, and equipment better suited for another catch.

In real terms, these businesses die because they search for an elusive r+d breakthrough or blitzscalable business, when all they need to do is sell a product for more than it costs to make.

So how do we finance startups without chasing whales?

Before there are legos for debt, you simply have a team, a plan, and whatever morsels of product-market fit you can find.

A boat can go out to sea with an A-plus crew and not catch whales. They can catch cod, crab, or bass, and return to shore with plenty of profits to go around.

In the course of building a $1B business, founders will have to build a $100M business. And a $10M business. And even a $1M business. Any of these businesses are achievements of a lifetime.

So how do we support a more holistic fishing industry? How do we fund all qualified fishing crews - not just the ones that promise whales?

A Moment for Equity 1.5.

Equity 1.5 describes the countless equity investment checks that get written to companies without any expectations of catching a whale or a billion-dollar valuation.

The majority of these checks are written by angel investors and a “friends and family” relationship is often play. The investor comfortably locks themselves into equity ownership, trusting that the business will make them whole. Returns, if they come, come in the form of an exit, dividends if the company can afford them, or just friendly discounts. The equity 1.5 economy straddles both sides of a formal and informal economy.

An economy that relies on informal relationships doesn’t scale. A founder whose “friends and family” do not include angel investors has to go find formal economic relationships. In the startup funding world, these are VCs and their derivative angel networks.

This is where a genuine need for risk capital ends up mutating the business into one that fits venture capital. VCs and the vast majority of professional angel investors have a specific business model - high-risk whaling portfolios.

Therefore, the more informal and flexible return expectations of Equity 1.5 aren’t available to founders without wealthy “friends and family.”

This is how the capital creates the business model, instead of the other way around. Countless founders are forced to go chase whales from day one simply because the only funding they could find was for whaling expeditions.

The low-hanging fruit for Risk Capital 2.0 is to formalize Equity 1.5.

There are equity investment strategies that are not reliant on whale-sized billion-dollar exits. Smaller exits happen all the time, they just don’t steal the headlines.

There are a few different folks attacking this at different angles.

In one camp - you have TinySeed. They invest in early-stage b2b saas, optimize for a lower failure rate and more 8 figure exits (and build in dividends - a 2.0 feature). That’s a lot of investor-ese to simply say, they have found a “small exits” strategy that is lucrative for both them and their founders. Within my own day-to-day, GCVF is starting to surface a portfolio that makes room for both “venture-scale” exits as well as a healthy sprinkling of “Equity 1.5-sized” exits. Along with a handful of other venture investors, we’ve found an unserved corner of startups where terms are realistic and next rounds are only raised if needed. The result - meaningful returns to our portfolio without having to catch a whale with every check. Our portfolio feeds off of swordfish, tuna, and crab too.

Equity 1.5 is even being tackled from the other end - the acquisition-side. Firms like Sureswift and Tiny Capital will buy companies at a point when they’re life-changing for the founders and still considered miniscule exits for traditional VCs. Microacquire even offers a marketplace for these exits (Funding 2.02 - buyers can even use Pipe to fund the acquisition).

If done right, Equity 1.5 scales the blatant optimism of venture capital down to meet the reality of more businesses. More diverse risk capital options will support more diverse business models instead of mutating them all to become whaling expeditions. Equity 1.5 will normalize exits of more sizes and incentivize more professional investors to build portfolios around them.

Enter Risk Capital 2.0

There’s a dirty little secret behind most billion-dollar companies - they were once $100M companies. It gets better too. Before they were $100M companies, they were $10M companies and even $1M companies.

Moreover, many founders aren’t starting their company to reach a billion-dollar IPO. Many founders just want to solve a problem, support their family, or just go on a lucrative journey.

“Realistically, many founders just want to build something audacious and don’t know their end game.”

They start by generating real-time financial success in the form of revenue, profits, and personal income. Most founders focus on growing those numbers. They head out to sea, find lucrative fish of all types, and catch them. Risk Capital 2.0 (RC2) takes into account a company’s real-time financial success and tolerates a more everyday promise of growth from founders.

So how does RC2 work?

Like Equity 1.0, it does put investors on a cap table (or often at least as much as a SAFE or convertible note does). This equity ownership accounts for the ever-present reality of an exit; sometimes a fishing vessel lands a whale. When an exit comes along, investors participate in the upside.

It also adds a release valve, offering founders a chance to buy back their equity by sharing real-time financial success.

The “shared” returns could be a revenue share. Or profit share. Or an income share. Or a SEAL. Or a SPACE. Or an ISA. At GCVF, our RC2 investments use a version of the Indie VC V3 docs. Regardless, as the company marches from $100k to $1M to $10M, investors participate in the growth of the same financial metrics that a founder focuses on daily.

RC2 builds off of Equity 1.5 by offering more than one path to returns for investors (exit distributions meet shared realtime returns). It puts more audacious founders in business and tolerates the logical unknow of a company’s endgame. This further enables investors to build portfolios that feed off of tuna, bass, and crab.

RC2 lets any audacious business become the business it is meant to be, not what a portfolio needs it to be.

All together, Funding 2.0 is the best funding landscape any founders have ever had access to. Centuries of financial innovation can now provide more opportunity and optionality to founders than ever before.

Looking ahead:

Funding 2.0 is still young and incomplete. In reality, nearly every founder still operates within Funding 1.0, meaning hundreds of thousands of businesses fall into the funding gap, failing to raise their startup capital.

For now, to mind the gap, many founders must carefully jump between funding offerings. Each business can mix and match its ideal funding cocktail, but it requires diligent financial acumen. Funding 2.0 is progress, but far from perfect financial access for all.

If we expect the 5.4 million businesses started in 2021 to reverse America’s 40-year entrepreneurial slump, Funding 2.0 needs all hands-on deck.

More Reading: