Can redeemable equity kickstart broad-based ownership?

Seeking perspectives from beyond the trough

I get worried when things seem like they make a little too much sense.

Do the dots I see actually connect? Or is that just an illusion?

It is easy to glaze over the trough of despair, while the true experts spot your beginner’s naivety from the other side.

And the last thing I want to do is blindly leap from one dot to another. Those are the kind of mistakes that are hard to recover from. That is how you don’t just descend into the trough, but rather crash and burn into it.

There are countless innovative finance dots which I am tempted to connect. This could be said about any post to date, but especially the next few. Think of these as an incomplete list of questions, ideas, and curiosities whichI think could be helpful for the future of finance, so long as they are not as naive as I suspect.

Please reply if you have perspective from the other side of the trough.

What is the true potential of redeemable equity?

Redeemable equity is an equity investment which has a predefined manner of being bought back from the investor to the company. As opposed to an exit, investors get liquidity in exchange for allowing the company to buy their shares back. The “buyback” mechanism can be automatic, through a revenue share or profit share, or discretionary, meaning if/when the company chooses.

Upon redemption, the shares are returned to the company as common shares. Is it safe to say, these are effectively returned to the founders?

Here’s my thinking:

Advisors and employees get shares authorized and issued in predetermined share amounts. This is why employee option pools often have to get “topped off” when companies raise multiple rounds. If more shares had to get created and issued to raise a round, the 100 shares that used to be the 10% option pool now may represent 5%. Thus, another 100 shares must be doled out.

When a redemption occurs, those shares go back into the common pool. Lacking a designated place for reissuance, such as the option pool, they are owned by the founders by default.

This is where my question comes in:

Can we redeem shares to any stakeholder we want?

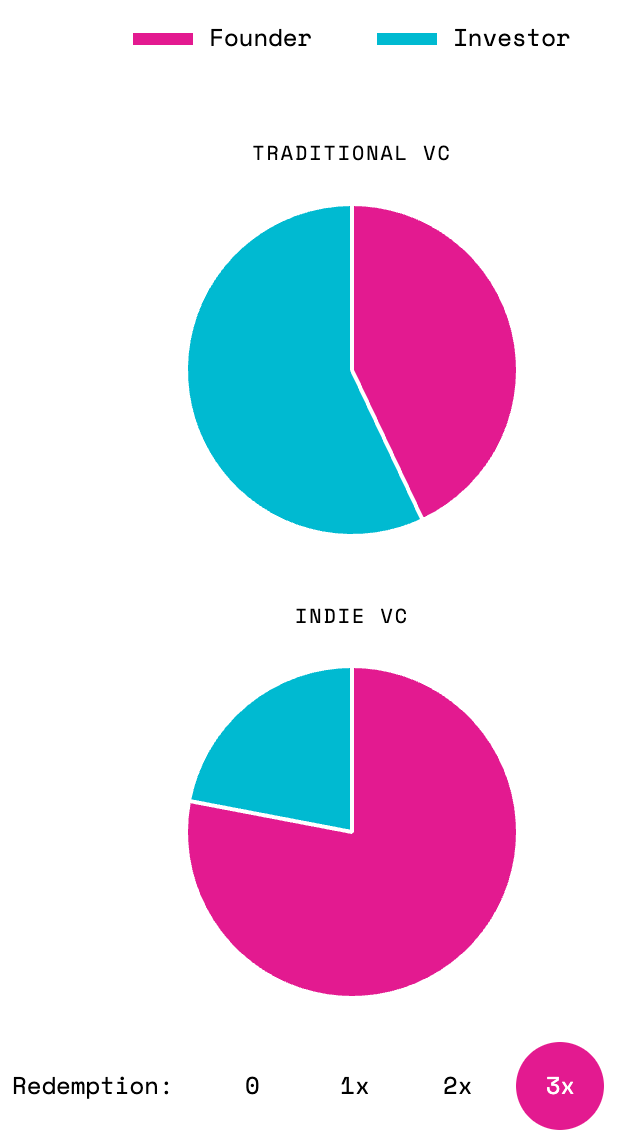

Founder’s Shares - As discussed, this is the default. As a result, redeemable equity competes with equity from angels or VCs as it allows founders to unwind the initial dilution from a seed round. This is most compatible with companies that don’t see a need for multiple rounds of VC.

Employees - Why not specify that the shares will be reissued to employees? For a company, taking this investment is a two part strategic move - first cash for growth, then equity to incentivize employees to sustain the growth. Could redeemable equity be a lightweight way to start sharing ownership without majority ownership transfer?

Any Stakeholder - Lastly, why not designate the redemption for other stakeholders? Suppliers, community, or even causes all become viable partial owners. This is largely the appeal of ownership via perpetual purpose trusts, but in a much more incremental manner.

This is where the next question comes in:

Are we leaving a lot of ownership unshared by painting it as black and white?

Thus far, shared ownership is positioned as a black and white matter. There are companies which are still taking founder’s stock and handing it out to investors and employees as they go. They are old-fashioned and perpetuating the status quo. And then there are companies wholly owned and governed by employees or a purpose trust. They are enlightened.

The reality of ownership is full of gray space. Some companies are majority employee owned, yet still have minority investors. Others are majority founder or investor owned, but have created very meaningful minority employee option pools.

As it pertains to governance, I’ll immediately concede. The shareholders with control have undue sway on company direction. However, most governance matters are overridden by economics. In other words, alignment over meaningful economics makes most governance matters moot points.

As it pertains to ownership however, the act of issuing shares, why not point redeemable equity toward a broader base of owners?

I wouldn’t be surprised to find out this is already being done. And every company will undoubtedly have its own circumstances and relevant stakeholders to get onto the cap table.

Nonetheless, we could be returning equity straight from investors to the owners of the future economy we would like to see. Investors using redeemable equity are still free to pursue whatever return targets they like. They’re getting bought out, so who buys them out is less important.

This puts the keys to distributing ownership in the hands of founders and CEOs - the ones raising the money. Are there business leaders out there who would love to share their cap tables but currently feel sidelined by the tools available? So long as pre-investment common holders can accept the dilution, why not use the redemption as a tool to get a broader base of stakeholders invested in the company?

Is redeemable equity as viable as I think for incrementally distributing ownership?

*I am intentionally setting aside the legal and tax complexity of employee ownership tools. That may be for a later post. For now, this presupposes that at least one of these tools - option pools, ESOPs, trusts, could be a viable recipient of redeemed shares. A later post may naively opine on which tools may work best for what.