Optionality in Investments: Balancing Hyper-Growth and Sustainability

Both paths (should) lead to the same place

Despite what the headlines tout, I’ve never met an investor who wants growth at any cost.

In fact, an investor's job is to contextualize the growth, the story behind the numbers, the associated risks, and the potential. Some common benchmarks for contextualizing growth are:

Rule of 40 (later stage/high margin)

T2D3 (early stage)

Burn rates and months of runway (any pre-profitability company)

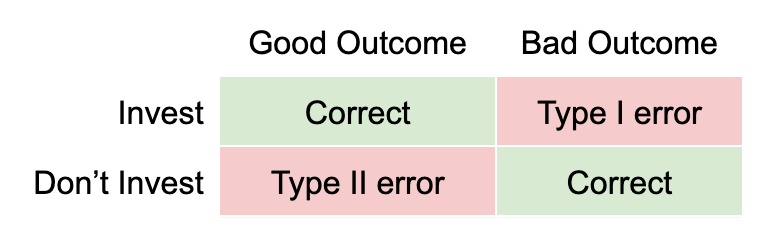

While having a quick metric for initial investment decisions would be nice, relying heavily on pass/fail criteria can lead to missed opportunities (Type II errors).

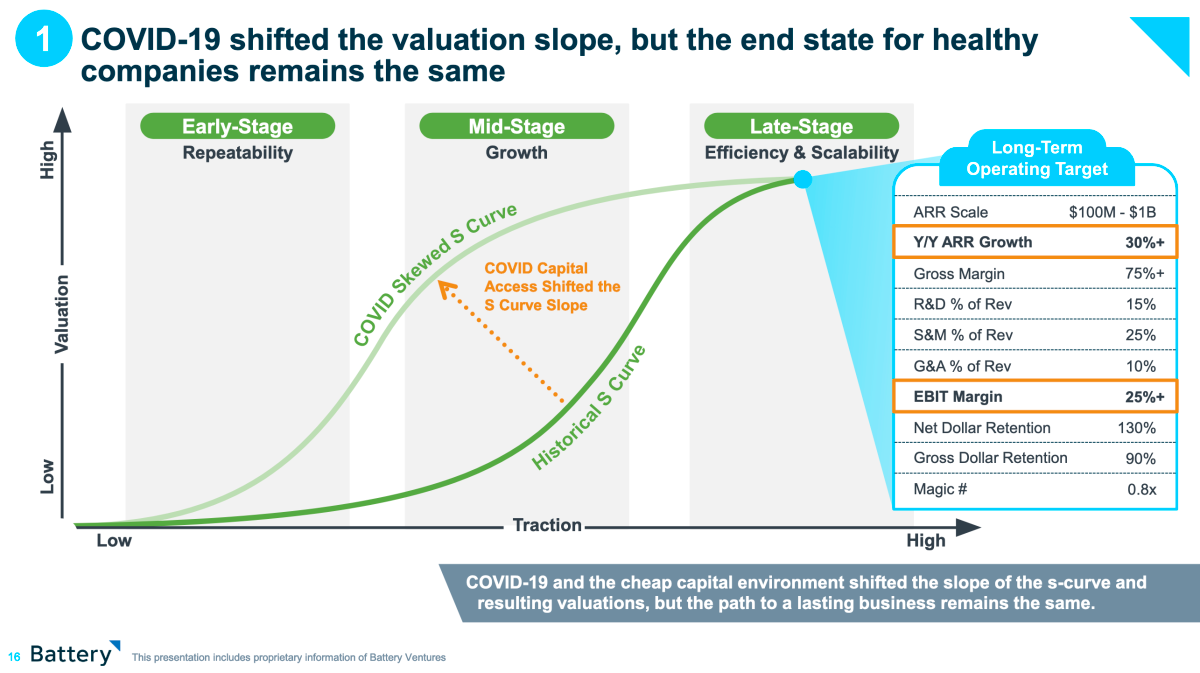

For those ventures starting out, rapid growth is critical. But as they move closer toward acquisition or an IPO, the narrative shifts. It balances the need for growth and the scalability of a sustainable business model. For venture-backed firms, there is no absolute choice between rapid growth and a sustainable business model.

This page from a Battery Ventures report from late last year illustrates this dual journey. Whether a company prioritizes growth or sustainability, the destination remains the same: achieve both.

If too fixated on growth, you might overlook the diamond in the rough that’s primed to scale but hasn’t shown that track record.

The same is true with a metric focused on past or current scaling efficiency. A company running on all cylinders with customer acquisition but isn’t currently focused on improving scaling efficiency might get overlooked without a more in-depth look.

Mistakes in investing, especially Type II errors, sting. They are painful and hard to forget. But they also teach that standard advice might lead one astray.

What is an investor supposed to do?

Back to the Basics

To maximize a company's outcomes, we need to recognize the need to transition through different tactics, sometimes throttling back to focus on efficiency and sometimes putting the pedal down for breakneck growth.

These metrics we often rely on? They're signposts, hinting at the path a company might be on.

While I might believe in a business's potential, it doesn't mean I'm all in for unchecked growth. We're going to oscillate on our way to scale and sustainability.

At different points in a company's lifecycle, it may have more leverage in growth and, at other points, more opportunity to create efficiency and incremental profitability.

My job is to find companies mapped toward the sweet spot of scale and sustainability.

Optionality

Capacity’s particular investment approach targets companies with a “line of sight” to profitability, partially validated by existing revenues. We also look for companies with the potential to switch between aggressive growth and sustainable growth strategies.

This means a solid foundational model, promising margins, and a clear path to breaking even. It doesn't mean we're advocating for slowing down growth, but it's comforting to know the option exists if the hyper-growth trajectory isn't as linear as we'd like.

If our bets pay off, the company gracefully transitions between these two strategies, maximizing valuation by mastering both. If things lean more towards sustainability and less towards growth, we have backup plans, like a structured exit. And if the scales tip the other way? Well, there's always the next investment round, with valuations rooted in growth.

If there were a magic metric to predict success, my job would be easier (and I'd definitely share it with you!). But for now, invest in the line of sight we and the founders see together, whether that currently leans towards growth or profitability. After all, both paths lead to the ultimate goal: sustainability and scale. And that is a win-win for both the investor and the entrepreneur.